Even allowing the affordable use of Starlink in the Falkland Islands represents a significant transformation opportunity, Starlink’s current status in the Falkland Islands is just one small battle in the global war between Geostationary High-Throughput Satellites (GEO-HTS) and Low-Earth-Orbit High-Throughput Satellites (LEO-HTS).

Many systems, applications, and services depend on cloud-based infrastructures in today’s interconnected world. The Falkland Islands are no exception, as islanders experience disruptions whenever Internet connectivity via Sure the Falkland Islands is compromised, such as during the outages in 2019 and, more recently, in 2024. Regardless of whether the cause is a Distributed Denial of Service (DDoS) attack, an infrastructure issue, an Intelsat satellite outage, or even a problematic update like the recent CrowdStrike incident, the result is the same: everything comes to a halt.

The selection of satellite technology, or a combination thereof, is crucial for the Falkland Islands’ economic and social development. Evaluating the potential wide-scale introduction of Starlink to the local market by reducing VSAT licence costs requires an understanding of global technological advancements in the satellite industry and their subsequent effects on local telecommunications providers, such as Sure Falkland Islands.

What are ‘HTS’ satellites, and what are the differences between ‘LEO’ and ‘GEO’ satellites?

High Throughput Satellites (HTS)

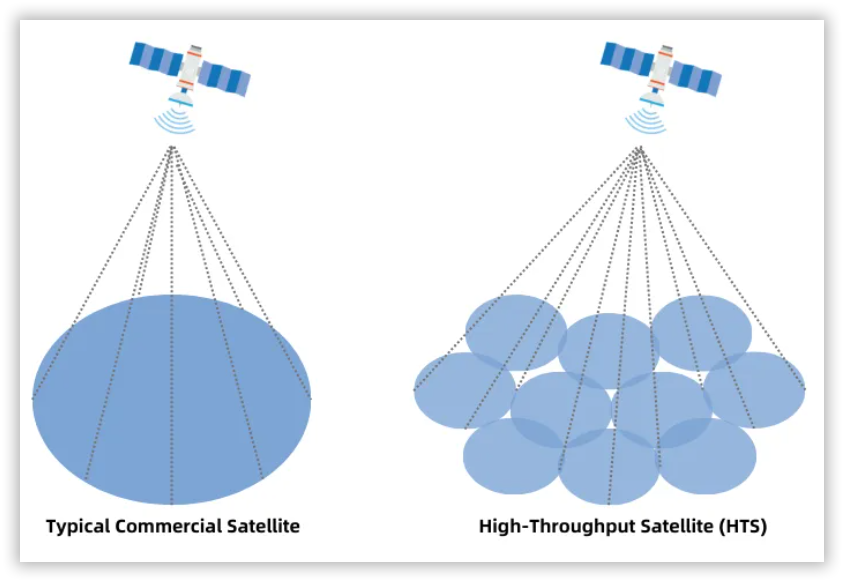

This term can be applied to both GEO and LEO satellites. Advanced High-Throughput Satellites provide significantly higher data rates than ‘traditional’ older satellites. They achieve this by using multiple ‘spot beams’ instead of a single broad beam. These spot beams can be simultaneously pointed at separate geographic areas of the earth. HTS satellites not only support high data rates of 100s of mbit/s but also have much higher aggregate throughput capacities. They are also very cost-efficient compared to traditional broad-beam satellites. However, they are very complex and expensive to manufacture and operate.

Source & thanks: IPLOOK

Source & thanks: IPLOOK

High Throughput satellite (HTS) technology is particularly effective for providing fast Internet access services, representing a significant advancement in satellite communications. This technology enables enhanced connectivity globally. Indeed, most new GEO and LEO satellites being launched today can be classified as HTS satellites.

What are GEO satellites?

A Geostationary Earth Orbit (GEO) satellite orbits the Earth at an altitude of 35,786 kilometres. At this height, it matches the speed of the Earth’s rotation and remains stationary relative to its surface. This enables the use of fixed antennas, such as those at Sure Falkland Islands’ site in Stanley, to maintain a constant connection with Intelsat’s GEO satellite. From this altitude, a GEO satellite can cover about one-third of the Earth’s surface and provide continuous 24-hour connectivity.

GEO satellites are primarily used for broadcasting television channels, communication services, and providing Internet access. Before the advent of Low Earth Orbit (LEO) satellites, GEO satellites dominated the commercial market. They have been used for decades, offering well-understood technology and a long lifespan. Very Small Aperture Terminal (VSAT) satellites are a type of GEO satellite.

GEO satellites are ideal for broadcasting because such services are not affected by their main drawback, which is a high round-trip delay (latency) of over 550 milliseconds. When combined with terrestrial path delays, the total latency can reach>850 milliseconds. Even the new generation of HTS deployed in the late 2020s experienced these delays due to the fundamental laws of physics.

This high latency is problematic for real-time interactive applications, such as voice communication, gaming and cloud-based distributed services, which really require round-trip delays of less than 150 milliseconds.

What are LEO satellites?

When discussing Low-Earth Orbit (LEO) satellites, we refer to constellations rather than individual satellites. Starlink and OneWeb are notable examples, along with Amazon’s Project Kuiper. LEO satellites orbit the Earth at altitudes ranging from 180 kilometres to 2,000 kilometres, much closer than GEO satellites. Specifically, Starlink operates at approximately 550 kilometres, while OneWeb orbits at about 1,200 kilometres.

LEO satellites complete an orbit in 90 to 120 minutes. Each satellite uses ‘spot beams’ to cover smaller areas of the Earth’s surface as they pass over at high speeds of around 27,000 kilometres per hour.

Starlink and OneWeb are inherently HTS constellations, capable of supporting data rates in the hundreds of megabits per second (Mbit/s). Their proximity to Earth results in much lower round-trip delays than GEO satellites. For instance, Starlink has demonstrated download speeds exceeding 300 Mbit/s and round-trip delays to the UK of around 70 milliseconds, compared to over 550 milliseconds for GEO satellites in the Falkland Islands. However, LEO satellites have their drawbacks; high cost and their low orbits make them susceptible to atmospheric drag, which reduces their operational lifespan.

The primary benefit of HTS LEO constellations is their low latency, which, unlike GEO satellites, makes them ideal for real-time interactive communications, voice-based services, gaming, financial trading, and cloud-based applications.

In summary, while GEO satellites are optimal for broadcasting services, LEO constellations excel in real-time, high-download-speed services in remote locations. Of course, they will not replace terrestrial or undersea fibreoptic cable connectivity where this is achievable.

What is the ‘cutting-edge’ service for GEO and LEO satellites?

Internet access is a significant revenue driver for both GEO and LEO satellite technologies. Historically, GEO satellites provided Internet connectivity to remote areas, but LEO constellations have emerged as a powerful alternative. While GEO satellites are effective for broadcasting TV, they are much less suited for interactive applications due to their higher latency.

LEO constellations like Starlink offer high download speeds and low latency, making them particularly well-suited for Internet access services. Previously, GEO satellites represented a necessary compromise for Internet connectivity, but the advent of LEO constellations has introduced a transformative option that addresses the limitations of GEO satellites.

Starlink, in particular, is a prominent market disruptor, and the shift it represents is significant and unavoidable. The rise of LEO technology is reshaping the landscape of global internet access, and its impact should not be ignored or dismissed as there will be significant social and economic impact by doing so.

Market dynamics & Potential winners.

Before Starlink, the market for satellite data communications was largely homogeneous, dominated by GEO satellites from providers like Hughes, SES, and Intelsat which is used by Sure Falkland Islands as its ‘upstream provider’. As we have discussed many times, lower-capacity VSAT data communication was not encouraged for use in the Falkland Islands.

However, looking ahead, the global market will likely fracture significantly, driven by diverse customer needs. This fragmentation will result in four evolving market sectors, each relevant to non-military telecommunications services in the Falkland Islands.

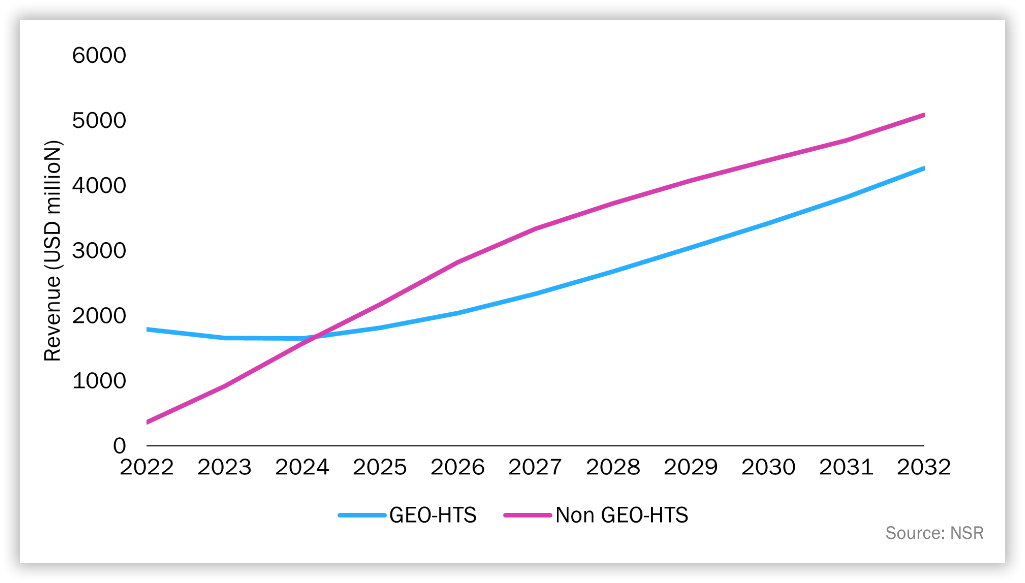

Consumer satellite Broadband service revenue, North America, 2022–2032

Source & thanks: analysys mason

Broadcast TV services.

Broadcast TV will continue to be dominated by traditional, reliable, cost-effective GEO satellites. After transmission by GEO satellite, TV channels are then distributed to the community using UHF Digital Terrestrial Television (DTT) technology.

Two companies provide these services in the Falkland Islands. The British Forces Broadcasting Service (BFBS) offers time-corrected UK channel broadcasts from Sappers Hill and directly into Camp. BFBS also provide an online TV and movie ‘broadcast’ service over Sure Falkland Islands’ local IP network called MiPlayer. Meanwhile, KTV provides TV subscription-based packages throughout the islands.

However, GEO-based TV broadcasting is under tremendous market pressure due to the uptake of Internet-based services. Even Sky is slowly moving toward Internet delivery of its services and the eventual shutdown of satellite delivery.

Interactive services

Sure Falkland Islands has relied on an Intelsat GEO satellite to deliver Internet access services. This approach is a real compromise due to the high costs associated with the limited capacity available on GEO satellites and the high capacity costs. In 2019, Sure stated it could not double its satellite capacity without a £1 million annual subsidy from the Falkland Islands Government. Intelsat’s GEO satellite’s limited capacity and affordability forced Sure to implement a restrictive quota system to manage internet usage on the islands. Without this system, the service would likely collapse during periods of high congestion. LEO services are usually quota free.

Due to performance and cost limitations, GEO-based Internet access services are not ideal for interactive applications, but no other technology was available in the 2015-18 time window. Using an undersea cable was not feasible or affordable, and it probably still isn’t. LEO-based services now represent the future of Internet access for consumers and businesses in remote or under-populated locations like Camp.

Migration from GEO broadcast to online streaming.

Personal streaming by services such as Netflix, Amazon Prime, YouTube, Disney+, and Paramount+ is a significant driver behind the shift from broadcast TV distributed by GEO-based satellites to accessing content using LEO-based Internet streaming. As consumers transition from traditional GEO satellite TV broadcasts to online streaming, the distinction between these services is increasingly blurred. This trend is fueled by the availability of quota-free, high-speed LEO-based services like Starlink. As a result, traditional GEO satellite service providers face severe revenue challenges as their customers migrate.

The other major trend driving consumers to Internet streaming is the improved picture quality now experienced on streaming services. Broadcast TV is limited to SD or HD resolution. Content creators now create most of their content in UHD / 4K resolution content with High Dynamic Range (HDR) colour depth. If you want to experience this, then consumers MUST go online. This particularly impacts BBC, which shows UHD 4K HDR on iPlayer and ITV on ITVX. With ITVX, there is an added benefit of an Ad-free subscription, which is very popular of course.

It shouldn’t be forgotten that even watching HD content is currently problematic on the islands as it requires >6Mbit/s download speeds, let alone UHD 4K, which requires >15Mbit/s download speeds.

Mixed usage

Most countries and islands, such as the Falklands, will have a mixed market, that uses both GEO and LEO services based on specific needs. There will not be a single ‘market winner’ as such. LEO-HTS services such as Starlink will continue to grow exponentially over the next few years, but GEO-based services will remain strong for broadcast services.

Both technologies will continue to coexist but with a significant shift from GEO to LEO-based Internet access services.

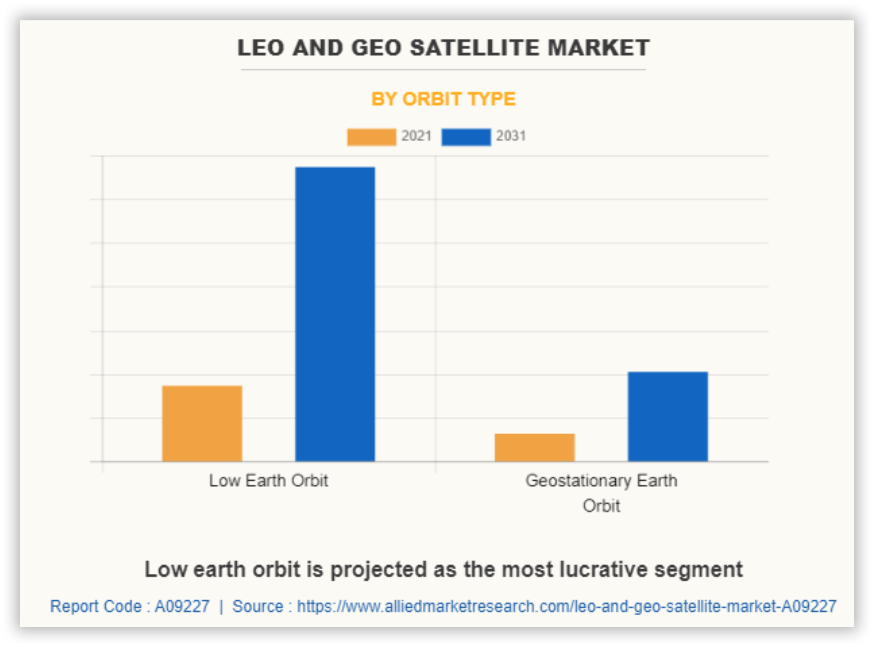

GEO – LEO Market growth forecast 2012-2031

GEO – LEO Market growth forecast 2012-2031

What determines end-user Starlink pricing?

The primary factor influencing end-user Internet access prices is competition. In areas with no competition, such as the Falklands today, prices are based on a cost-plus philosophy, though the exact margin remains undisclosed as it is considered “commercially confidential.” In such markets, prices tend to relentlessly trend upwards but can be somewhat regulated through government price controls.

Starlink’s Pricing Strategy

Starlink’s situation is no different. As of 2024, estimates suggest that SpaceX has invested between $10 billion and $15 billion in the Starlink project. These investments have established Starlink as a leading satellite internet provider, significantly surpassing competitors like OneWeb and Amazon’s Project Kuiper in deployment and subscriber numbers. By mid-2024, Starlink had amassed over 3.2 million subscribers globally, generating more than $2 billion in annual revenues.

This substantial expenditure covers satellite manufacturing, launches, ground infrastructure, and various operational costs. Clearly, these are vast investments that will probably not be recouped for decades. End-user prices are not set on a straightforward cost-plus basis, but perhaps one day they will be.

Starlink’s pricing strategy is designed to be competitive. Its variable monthly rates are tailored to each country it serves. The goal is to balance affordability with the costs of maintaining and expanding its satellite network.

Conclusions

I started this post by stating that the possibility of using Starlink in the Falkland Islands is “just a tiny battle in the global war between GEO-HTS and LEO-HTS satellites.” I hope that I have provided some background to help show this statement’s veracity.

However, Starlink is not a “tiny” issue for the Falklands’ residents and businesses. It is a very serious issue in the islands, as it is in many other countries worldwide. It will profoundly impact all aspects of life for consumers, businesses, and the government.

The migration to LEO-based Internet access services will have the same transformational impact on the telecommunications industry reliant on GEO satellites as the move from traditional voice networks to voice-over-IP (VOIP) services had on them 20 years ago. Don’t look for too many positive views about Starlink from GEO satellite operators and those affected local incumbent carriers!

Chris Gare, OpenFalklands July 2024, copyright OpenFalklands

https://uk.pcmag.com/networking/151274/hughesnet-lost-200k-satellite-internet-users-last-year-amid-starlink-competition

Satellite internet service Viasat has lost over half of its US subscribers since the debut of Starlink.

In a Wednesday letter to shareholders, Viasat revealed the company has 257,000 subscribers to its US fixed broadband business. That’s a major drop from the 603,000 subscribers it had in September 2020—right before SpaceX began inviting the first users to try out Starlink.

The 257,000 figure also appears to be the first time Viasat has publicly reported its US subscriber numbers since May 2021, when its US subscriber base had fallen slightly to 590,000.

https://uk.pcmag.com/networking/153794/viasat-has-lost-over-half-its-us-subscribers-since-starlinks-debut